- Pdf To Txf File Converter

- Txf File Converter Mp3

- Txf File Converter Pro

- Turbotax Txf File Format

- Txf File Converter File

- Csv To Txf Free

Introduction

The TXF standard was established in approximately 1991. The ability to import files in the TXF format has been a feature of desktop tax preparation software such as Intuit TurboTax and Block Tax Cut for many years.

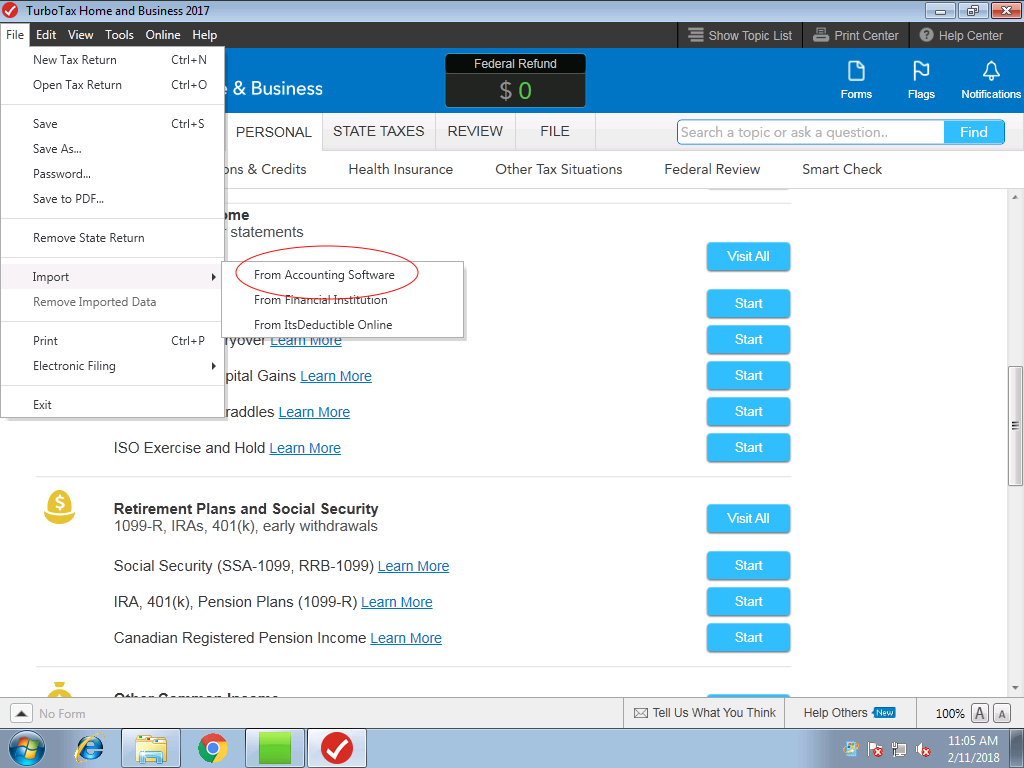

For example, to import a TXF file in TurboTax, you select 'File' then 'Import' and are presented with the below screen.

Convert your audio, video and pdf files to other formats. We support over 100 input formats you can convert from. Optionally extract audio from a video. TXF Reader - TXF2CSV. TXF Reader can combine TXF (Tax eXchange Format) records and generate Form 1040 Schedule D reports (Form 1040) directly. You can also convert TXF files to CSV (Comma Delimited) files. The converted CSV files can be imported into a spreadsheet application (e.g., MS Excel) for the purpose of tracking transactions or filing tax returns. Choose the PDF file that you want to convert. Select TXT as the the format you want to convert your PDF file to. Click 'Convert' to convert your PDF file. Zamzar Pro Tip: If you are on a Mac then you can use the Preview application to open PDF files. Jun 30, 2020 There is no TXF file for download. The CSV file, however, is available. I have tens of thousand of transactions in 2019 which makes manually inputting them into Turbotax impossible. Is there a way to convert the CSV file into a TXF file so that I can import it into Turbotax? Convert.csv tax files into.txf files Getting your 1099-B cost basis information into your favorite tax software can be a time-consuming task. TurboTax® and TaxCut® support direct 1099-B downloading from only a few brokers.

You select 'Other Financial Software (TXF File)', and then browse to the file as shown here.

Usage

TXF has been used extensively for:

- Form 1099-B broker transaction data import.Brokers such as TD Ameritrade and Interactive Brokers supply TXF files.

- Form 1065 Schedule K-1 data import. Sites such aswww.taxpackagesupport.comsupply data files in the TXF format.

Recent History

With the advent of online tax software, unfortunately,the use of TXF import declined in favor of OFX import.

We say unfortunately because:

- OFX does not support all of the data that TXF supports and

- It is not practical for all issuers of tax forms to operate an OFX server and interface with all tax software programs

We are not aware of any web-based tax software that imports TXF files.

The TXF standard has not been updated in many years.And the last known web address for the documentation file,https://turbotax.intuit.com/txf, is no longer reachable. See a copy of the document here.

For these reasons, migrating to the FDX JSON format for file import is recommended.

TXF File Format

Sample File:

TXF files are ASCII files consisting of a header record (see header record below) followed by a sequence of data records.

Fields

Sample Field:

Each field consists of one line. Use of Carriage Return (CR) and Line Feed (LF) to denote line ending is preferred.

Each field has a single character (see 'Field Types' below) at the beginning that is followed immediately by the data for the field.

Records

Sample Record:

Each record consists of a sequence of fields.

Each record is terminated by a line which has one '^' (caret) character.

Header Record

Sample Header Record:

All Tax Exchange Files should have a header record.The header record defines:

- The version of the specification used. ('V')

- The program used to create the file. ('A')

- The date the file was created. ('D')

Field Types

| Character | Title | Explanation |

|---|---|---|

| V | Version | The version of TXF standard used to create the file. |

| A | Program Name | The name of the program creating the TXF file. The version number should also be included. |

| D | Date | Field contains a date. Use mm/dd/yyyy format. 'Various' is also allowed in some contexts. |

| T | Type | Either S for summary or D for detail. Default value is S. |

| N | Reference number | A 3 digit number used to map the data to the applicable line on the applicable form, schedule, or worksheet input field in the tax software. |

| C | Copy Number | The copy number for multi-copy forms (such as Schedule C). If there is only one copy, the value should be 1.If no 'C' field is supplied, Copy 1 will be assumed.The maximum number is 255. |

| L | Line Number | The line number for multi-line items. If there is only one line item, the number should be 1. The default value is 1. |

| X | Detail | Extra text that can be used by the tax software to populate a supporting statement. If used, these detail records should place data in columns as shown here: |

| $ | Amount | The dollar amount for the item. Income, gains, and money received are positive numbers. Expenses, losses, and money spent (including tax payments) are negative numbers. |

| P | Description | A description or other such text value |

Data Records

Sample Data Record:

Pdf To Txf File Converter

For each data record there are a set of common fields. In the recommended sequence, they are:

- T Type

- N Reference Number

- C Copy number

- L Line number

Data Record Formats

There are 7 data record formats. They are labeled 0 through 6. Each has various additional fields.

Record Format 0

Sample Format 0 Data Record:

Used for boolean records such as 'spouse' indicator

Record Format 1

Txf File Converter Mp3

Sample Format 1 Data Record:

A dollar amount field.Cents are allowed but many some tax software programs will round the value to the nearest dollar. Commas in the allowed in the thousand position, but not recommended.

Record Format 2

Sample Format 2 Data Record:

A string value used for 'description' fields. For example, Schedule C, Line A.

Txf File Converter Pro

Record Format 3

Sample Format 3 Data Record:

Used for fields requiring both a description and an amount. For example, interest income where bank name and dollar amount are required.

Record Format 4

Sample Format 4 Data Record:

Used to report sales of stocks, etc. Values are:

- P Security description

- D Date acquired. Some programs allow 'Various' here.

- D Date sold

- $ Cost basis

- $ Sales price, net of commission

Record Format 5

Turbotax Txf File Format

Sample Format 5 Data Record:

Sales of assets including stocks

- P Security description

- D Date acquired

- D Date sold

- $ Cost

- $ Sales, net of commissions

- $ Depreciation allowed OR Wash sale adjustment amount

Record Format 6

Txf File Converter File

Sample Format 6 Data Record:

Csv To Txf Free

Used for quarterly federal and state estimated tax payments. State code is ignored for federal estimated tax payments.Date paid, amount paid, and state abbreviation.